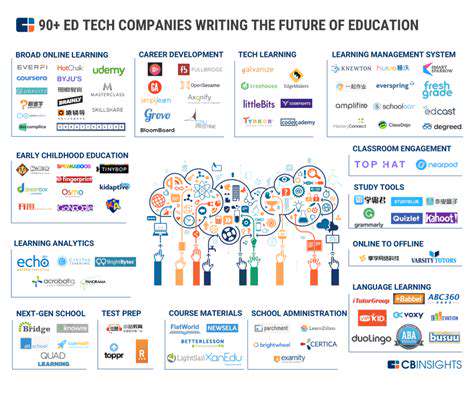

The Corporate Venture Capital Landscape for EdTech

The education technology sector is experiencing a transformative wave as corporate venture capital (VC) increasingly flows into EdTech startups. This isn't just about money changing hands - it represents a fundamental change in how innovation is cultivated and implemented across the industry. Corporations aren't merely investing; they're strategically positioning themselves to embed technological solutions directly into their operations and customer experiences. The primary motivations? Future-proofing their workforce and optimizing internal processes.

This corporate-led approach creates a distinct dynamic for startups compared to traditional VC models. While corporations offer substantial resources, established networks, and clear operational needs, their focused priorities might inadvertently narrow the scope of innovation. Startups may find themselves developing solutions that address immediate corporate demands rather than exploring groundbreaking educational paradigms.

Driving Innovation and Integration

The corporate VC model shines in its ability to fast-track the integration of educational technologies. When corporations invest in aligned startups, they gain first access to test and refine solutions within their own ecosystems. This creates a feedback loop where technologies evolve to meet precise corporate specifications, moving beyond generic offerings to customized solutions with measurable impact.

This symbiotic relationship fosters continuous improvement. As companies implement EdTech solutions, their real-world usage generates invaluable insights that startups can use to refine their products. Such collaboration creates a dynamic where corporate learning initiatives directly shape technological advancement, making professional development a core driver of innovation.

Beyond capital infusion, corporate VCs provide mentorship drawn from deep industry expertise. This guidance can prove instrumental for emerging EdTech companies navigating complex markets and scaling challenges. However, this model isn't without potential pitfalls - concerns persist about conflicts of interest and whether corporate priorities might overshadow broader educational needs.

The growing influence of corporate VC in EdTech demands careful consideration. While the benefits of rapid integration and resource access are clear, the sector must remain vigilant about maintaining solution diversity and educational accessibility for all stakeholders.

Beyond Traditional Venture Capital: CVC's Unique Approach

Beyond the Traditional Venture Capital Model

Conventional VC firms typically chase high-growth startups in familiar tech sectors, potentially missing transformative opportunities in less conventional spaces. This narrow focus can inadvertently stifle innovation in areas that don't fit the standard tech startup mold.

New investment paradigms are addressing these limitations by embracing a more expansive view of potential. These models acknowledge that meaningful innovation occurs across diverse sectors and requires flexible support structures tailored to each venture's unique context.

Expanding Investment Horizons

The traditional VC focus on early-stage funding creates gaps in later development phases. Alternative approaches recognize that ventures need sustained support throughout their lifecycle, from seed funding to expansion capital and strategic acquisitions.

This comprehensive perspective not only supports longer-term growth but also uncovers value in established companies with untapped potential, creating more robust innovation ecosystems.

Tailored Support for Diverse Ventures

Standardized VC approaches often fail ventures with specialized needs. The most effective alternative models provide customized mentorship, connecting entrepreneurs with niche expertise and targeted resources that accelerate their specific growth trajectories.

Impact Investing and Societal Value

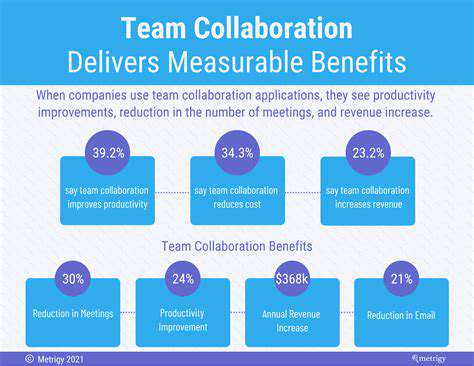

The rise of impact investing reflects growing recognition that financial returns and social good aren't mutually exclusive. Investors increasingly seek ventures that deliver measurable benefits to communities and environments alongside competitive financial performance.

Community-Based Funding Models

Crowdfunding platforms and community investment initiatives are democratizing access to capital, particularly for entrepreneurs in underserved markets. These models foster inclusive innovation by connecting ventures directly with their potential user bases.

Strategic Partnerships and Collaborations

The most transformative innovations often emerge at the intersection of different expertise. Strategic alliances between startups, corporations, and research institutions create powerful synergies that accelerate progress on complex challenges.

Accessibility and Inclusivity

Building equitable pathways for diverse founders is essential for a vibrant innovation economy. Alternative funding models that address systemic barriers help unlock the full potential of underrepresented entrepreneurial talent.

The Future of EdTech and Corporate VC

The Rise of Personalized Learning

Modern learning platforms are revolutionizing professional development through hyper-personalization. By leveraging advanced analytics, these systems create tailored learning journeys that adapt to individual strengths, weaknesses, and preferred learning styles. The results? Dramatically improved knowledge retention and skill application in workplace settings.

This precision approach contrasts sharply with traditional one-size-fits-all training, delivering measurable improvements in program completion rates and ROI for corporate learning investments.

Integration of AI and Machine Learning

AI is transforming corporate education from passive content delivery to dynamic, responsive learning ecosystems. Intelligent systems now diagnose knowledge gaps in real-time, prescribing targeted content and predicting future learning needs before they become performance issues.

These AI-driven platforms create personalized learning pathways that evolve with each interaction, making professional development truly continuous and contextual.

Augmented and Virtual Reality in Corporate Training

Immersive technologies are redefining hands-on training across industries. VR simulations provide risk-free environments to master complex procedures, while AR overlays contextual information onto real-world scenarios.

This blend of digital and physical learning creates unparalleled training effectiveness, particularly for technical skills and safety-critical operations where real-world practice would be costly or dangerous.