Trends in EdTech Investment: What's Next for Funding

The Future of Funding and Emerging Trends

The Rise of Crowdfunding

Crowdfunding platforms are rapidly evolving, offering diverse avenues for individuals and small businesses to raise capital. This innovative approach bypasses traditional financial institutions, connecting entrepreneurs directly with potential investors. The democratization of funding is a key feature, allowing projects to reach a wider audience and potentially garner significant support. This direct-to-consumer approach can drastically reduce overhead costs and expedite the funding process compared to traditional methods.

Beyond simply raising capital, crowdfunding platforms often provide valuable resources and support networks. This can include exposure to a broader market, advice from experienced entrepreneurs, and access to potential collaborators. This holistic approach can be instrumental in fostering innovation and facilitating the launch of new ventures.

Venture Capital and Angel Investors

Venture capital firms and angel investors continue to play a crucial role in funding emerging companies. Their deep industry knowledge and extensive networks often provide critical guidance and mentorship alongside the financial backing. These investors are typically looking for high-growth potential, and their investments can significantly accelerate the growth trajectory of startups.

However, access to venture capital and angel investors can be highly competitive. Startups often need to demonstrate a strong business model, a compelling team, and a clear path to profitability to attract their attention.

Government Grants and Subsidies

Government grants and subsidies are becoming increasingly important sources of funding for emerging ventures, particularly those focused on addressing societal challenges or promoting technological advancements. These initiatives often aim to stimulate innovation and economic growth within specific sectors. These forms of funding can be crucial for startups lacking the resources to secure traditional financing.

Navigating the application process for government grants and subsidies can be complex, requiring thorough research and a well-structured proposal.

Impact Investing and Social Enterprise Funding

Investors are increasingly recognizing the potential of impact investing, which prioritizes financial returns alongside positive social and environmental impact. This approach aligns with the growing demand for sustainable and responsible business practices. This type of funding is particularly attractive to social enterprises and companies seeking to make a tangible difference in the world.

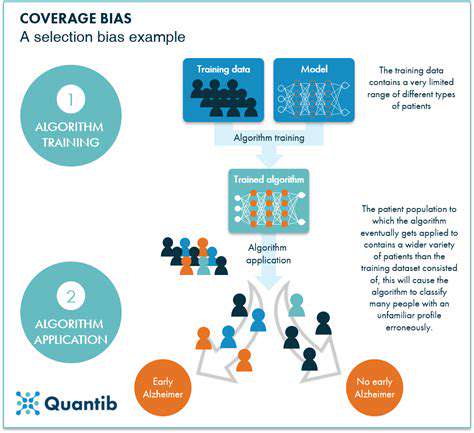

Alternative Financing Mechanisms

Beyond traditional funding avenues, a variety of alternative financing mechanisms are emerging. These include peer-to-peer lending platforms, which connect borrowers directly with lenders. This approach offers a potential alternative to bank loans, providing a more streamlined and accessible process. This is especially beneficial for businesses that may face challenges in securing traditional financing.

Blockchain technology is also creating new possibilities in funding, including tokenized securities and decentralized finance (DeFi) platforms. These innovative solutions have the potential to revolutionize how capital is raised and managed.

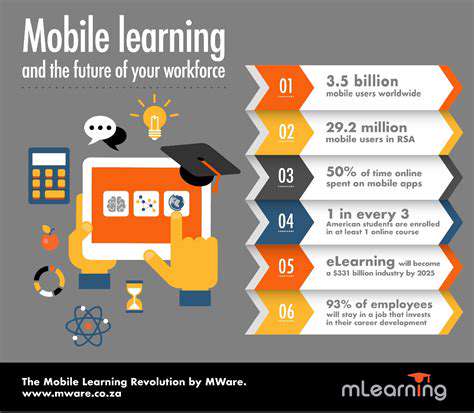

The Role of Technology in Financing

Technology is significantly impacting the future of funding, from streamlining the fundraising process to enhancing investment opportunities. Digital platforms are transforming traditional financial interactions, enabling faster transactions and broader access to capital. The accessibility of data-driven insights and predictive analytics empowers investors to make more informed decisions. This results in a more efficient and dynamic funding landscape.

The evolution of fintech and blockchain technology is poised to further reshape the way capital is raised and managed, fostering innovation and driving economic growth.

Read more about Trends in EdTech Investment: What's Next for Funding

Hot Recommendations

- Attribution Modeling in Google Analytics: Credit Where It's Due

- Understanding Statistical Significance in A/B Testing

- Future Proofing Your Brand in the Digital Landscape

- Measuring CTV Ad Performance: Key Metrics

- Negative Keywords: Preventing Wasted Ad Spend

- Building Local Citations: Essential for Local SEO

- Responsive Design for Mobile Devices: A Practical Guide

- Mobile First Web Design: Ensuring a Seamless User Experience

- Understanding Your Competitors' Digital Marketing Strategies

- Google Display Network: Reaching a Broader Audience